Cart

0

Product

Products

(empty)

No products

To be determined

Shipping

$0.00

Total

Product successfully added to your shopping cart

Quantity

Total

There are 0 items in your cart.

There is 1 item in your cart.

Total products

Total shipping

To be determined

Total

More info

Story Name |

SECTION NAME

www.ahametals.com

American Hard Assets

|

6

APMEX

SECTION NAME

| Story Name

7

|

American Hard Assets

www.ahametals.com

Audi

How to Find Gold With Extra Demand

6

World News

HARD ASSETS

11

Gold/Silver Ratio

NUMISMATICS

14

Simplfying Spot

20

Coins & Inheritances

28

Lunar Horse Coins

32

Modern World Coins

38

Gold with an Extra Measure of Demand

45

$20 Graded Gold

LIFE STYLE AND LUXURY

51

Beverly Hills Pawn

56

European Wine Tours

58

America’s Most Expensive Real Estate

61

State of American Watches

68

Presidents, Central Bankers and Bond Villans

AUCTION, COLLECTIBLES AND DIVERSIFICATION

72

Baseball Cards

79

To Clean or Not to Clean

80

War Nickels

81

The Four D’s of Selling

MINING & MINERALS

84

Mining News

REFERENCE

90

Preferred Dealers

94

Events

96

HindSight

2631367049

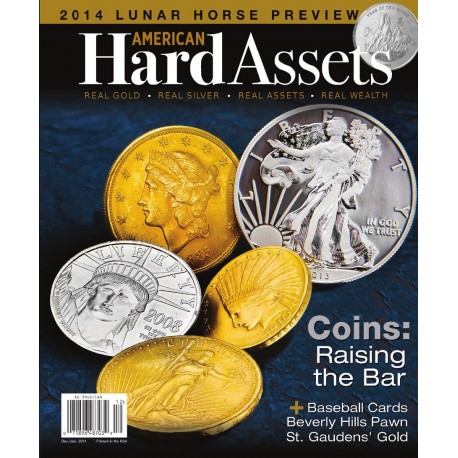

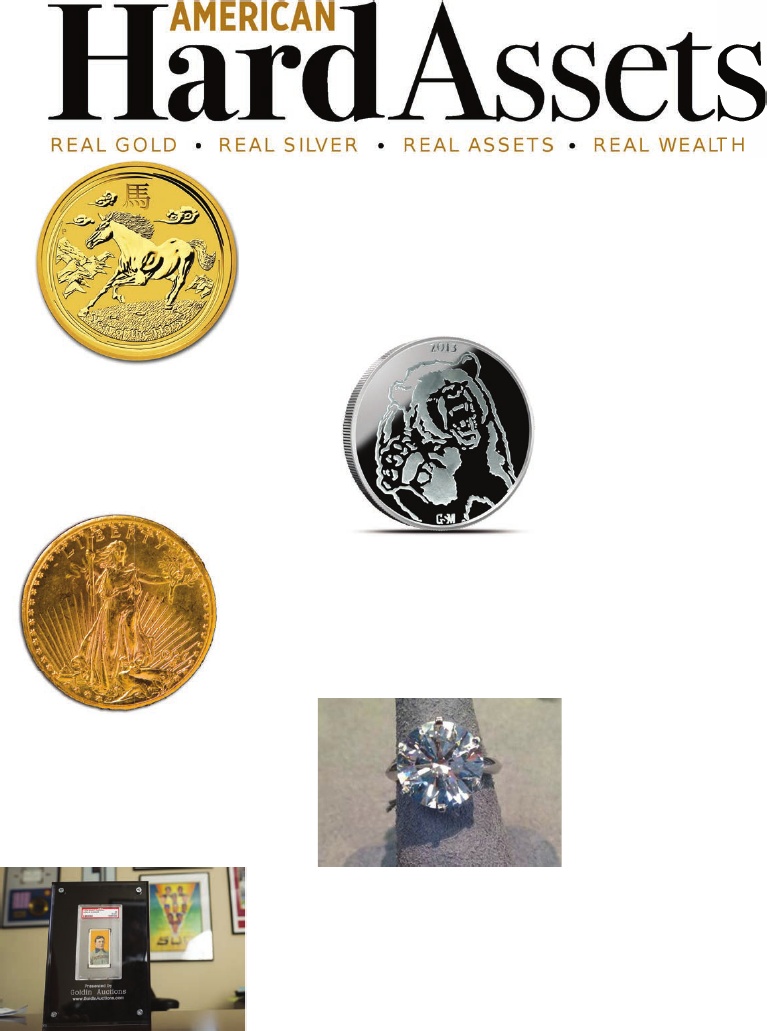

The 2014 lunar coins stampede into American Hard Assets as we highlight the horse series. Looking for a piece of gold with a high premium? Michael Haynes digs in to help understand how to find that numismatic piece with extra demand.

Childhood Investments

Everyone collected them as a kid, but for those who kept up with the market and their baseball cards, their collection could be a valuable investment.

Modern World Coins

Louis Golino takes you through the modern coins that are now available around the world. AHA sat down with Jordan Tabach-Bank of Beverly Loan Company to find out what 90210’s highest-end collateralized lenders actually do.

Beverly Hills Pawn2014 Lunar Series Preview

EDITOR’S NOTE

4

|

American Hard Assets

www.ahametals.com

Bullion or Numismatics?

One of the first questions I hear from people that are interested in jumping into the gold, silver and precious metals markets is: should we be buying bullion pieces, or are the collectible coins and numismatic pieces the safer play?I think it’s about time that we jump into the numismatic field and really investigate what it’s about. But first we start out with a piece by Tom Genot on the tax implications when buying or selling gold or numismatics. Next, and perhaps the most important part of the whole process, Mark O’Byrne explains what spot price actually is, and how it pertains to buillion pieces, numismatics and even rarities. Because who wouldn’t want to know how much their investments are actually worth?From there, we jump into how to go through those coins you inherit from a loved one to the newest versions of the lunar series, before analyzing the current modern world coins. Jonathan Kosares then analyzes why you may want to take a step back from numismatics in a rising market and Jordan Tabach-Bank runs up to the stage and explains the world of collateralized lending. Ever wonder why so many of the greatest watches in the world aren’t made in the United States? Ed Estlow explains exactly why the fall of American watch makers came to fruition. The lifestyle and luxury section features some great wines and the most expensive, yet beautiful housing markets in the US and Gabe Benson returns to explain how those childhood collections could become great investments . Don’t forget to visit our www.ahametals.com for the most up-to-date information and all of your gold, silver, auctions, collectibles and other precious metals news as well as some of the best price charts in the business. Happy Investing!

R

yan KasmierskyManaging Editor American Hard Assets

PRESENTED BY

:

AHA Metals, LLC

MANAGING EDITOR

:

Ryan Kasmiersky

EDITORIAL SUPPORT

: Aaron Solomon

ADVERTISING SALES

:

Sarah Kaiser

SUBSCRIPTIONS

: Leigh Chamberlain

CIRCULATION MANAGER:

Jennifer Cunningham

GRAPHIC DESIGN

: Open Look Creative Design www.open-look.com

GENERAL MANAGER

: Josh Eells

DIRECTOR OF OPERATIONS

: Mike Boniol

CUSTOMER SERVICE

: Sandi Heuerman

FRONT COVER

:

Photo Courtesy of APMEX

FEATURE WRITERS

:

Fred Reed, Nic Forrest, Ed Estlow, Mark O’Byrne, Michael Haynes, Gabriel Benson, Eavan Moore, Jonathan Kosares, Louis Golino, Scott Wayne

CONTRIBUTORS

:

Grierson, Greg Canavan, The Bullion Baron, Hector Cantu, Alistair Bailey, Mike Woodcock, Daryl Middleton, Michael Moore, Christy Stewart, Jonathan Kosares, Tom Genot

DISCLAIMER:

American Hard Assets is 100% American owned. All contents of American Hard Assets (AHA) are for information purposes only. AHA does not guarantee the accuracy, completeness or timeliness of the contents. None of the information contained herein constitutes a solicitation, offer, opinion, or reccomendation by AHA to buy or sell any security or commodity, nor legal, tax, accounting, or investment advice or services regarding the profitability or suitability of any security, commodity or investment. All commentary and advice in this publication is of a general natureonly, and doesn’t consider your individual circumstances or financialobjectives. You should always consult a licensed financial advisor foryour personal investment advice. Please do your own research.

CONTACT US FOR ADVERTISING

Publisher Inquiries: rkasmiersky@ahametals.com Advertising Inquiries: media@ahametals.com

SUBSCRIPTIONS

www.ahametals.com1.877.695.1258P.O. Box 835433Richardson, Texas 75083-5433

American Hard Assets is a bi-monthly publication and subscriptions are available for one year at $29.99.

Story Name |

SECTION NAME

www.ahametals.com

American Hard Assets

|

5

HARD ASSETS

| Tax Implications for Precious Metal Investments

T

he investment community purchases goldand silver for different reasons. Typically theyact as a hedge or protection from concernsover inflation or times of economic instabilityand uncertainty. They are valued in terms of currency,