Cart

0

Product

Products

(empty)

No products

To be determined

Shipping

$0.00

Total

Product successfully added to your shopping cart

Quantity

Total

There are 0 items in your cart.

There is 1 item in your cart.

Total products

Total shipping

To be determined

Total

More info

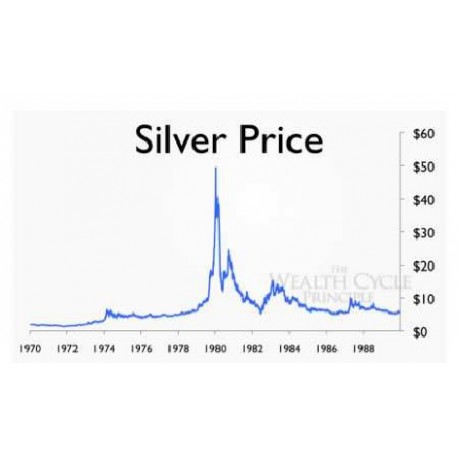

Millions of people have heard the ³official´ story of how the larger-than-life Huntbrothers drove the price of silver from under $2 an ounce to over $50 in an attemptto corner the market. At one point, the two colourful Texas oilmen owned the rightsto more than half the world¶s silver supply. But then it all came crashing down onSilver Thursday, March 27, 1980, when silver fell to under $11 an ounce. Instead of making billions, the richest men in America ended up losing the bulk of their family¶sfortune.

The Hunt Brothers²Sacrificial Lambs in Wolf¶s Clothing

I¶ve been studying the Hunt Brothers, and I have a different take on what reallyhappened. Because of the way they flaunted their wealth, because of ties they hadto the Middle East, and because they did invest so heavily in silver, the Huntbrothers were the perfect scapegoats for the anger and frustration most Americansfelt towards the lagging economy of the day.I believe that Bunker and his brother were used by the Federal Reserve, in collusionwith COMEX and the Chicago Board of Trade (CBOT), to cap the price of gold²YES, GOLD²and save the U.S. dollar.

Inflation Indignation

The period leading up to silver¶s spike was fraught with inflation, stagnant economicgrowth, and political upheaval. In 1965, President Johnson increased deficitspending to finance his Great Society programs, tax cuts, and an unpopular war inVietnam.In 1971, realizing that the U.S. Treasury didn¶t have enough gold to redeem all thedollars held by foreign governments and investors, President Nixon pulled the UnitedStates off the Bretton Woods monetary system²the last vestiges of a pseudo goldstandard. This action effectively created a worldwide fiat currency system thatcontinues to this day.

OPEC-generated oil shortages, along with real food shortages, fueled public fearsthat the U.S. economy was in crisis. By the late 1970s, inflation had become publicenemy number one.

The Hunt for Silver

The Hunt brothers could see the writing on the wall. With their great wealth beingsteadily eroded by skyrocketing inflation, they needed an asset to which they couldsafely anchor their massive oil fortune. At first, they thought of gold²history¶s safehaven. But in 1973, U.S. citizens were not allowed to own gold, and Bunker Huntthought the gold market was too easily manipulated for government purposes.1So the Hunt Brothers turned to silver, and started buying it at about $2 an ounce.Total world silver production was dropping, while industrial silver consumption wasexploding. And once government and private silver stocks ran out, the shortfallbetween supply and demand was certain to drive the price of silver skyward.By early 1974, the Hunt brothers had purchased futures contracts (agreements topurchase commodities in the future at a pre-determined price) for another fifty-fivemillion ounces of silver. This was on top of the massive hoard of physical silver theyalready owned.2 In April, Bunker Hunt stopped in New York to visit the COMEXtrading floor for the first time. When he walked onto the floor, the normal frenzy of activity came to a screeching halt. Who was this fat Texan in thick plastic glassesand a cheap blue suit? Rumours began floating that the Hunt brothers wereattempting to corner the market.The Hunt brothers used their positions in silver futures to acquire more of thephysical metal. Aware that cash was continually losing value due to inflation, theysettled their futures contracts with physical delivery of bullion, instead of cash, as ahedge against the government currency monopoly and global turmoil.Bunker kept quiet about his silver investments. But he made no secret of hisdistaste for the dollar: µµJust about anything you buy, rather than paper, is better,´ hesaid. ³«If you don¶t like gold, use silver, or diamonds or copper, but something. Anydamn fool can run a printing press.´

If You¶re Losing, Change the Rules

By October 3, 1979, silver hit $17.88 an ounce.4 The two major U.S. exchanges,COMEX and CBOT, started to panic: They held a measly 120 million ounces of silver between them, an amount typically delivered in a busy month.5 With silver pricespushing to new heights as new buyers rushed in, the exchanges became fearful thata default (inability to deliver) was imminent.The silver rush continued to accelerate, led by the Hunt brothers and their Saudi Arabian business partners. The Commodity Futures Trading Commission (CFTC),the government¶s futures watchdog, had become seriously alarmed at the prospects

of a shortage on the exchanges, and tried persuading Bunker Hunt to sell some of his silver.The billionaire resisted, believing that silver was a long-term play with an integral rolein the future global economy. The CBOT, backed by the CFTC, finally decided to puta stop to the Hunt brothers¶ buying²by changing its rules.Margin requirements were suddenly raised, and traders could hold no more than 3million ounces of silver futures; those holding more were placed in forcedliquidation. Bunker Hunt cried foul, accusing exchange board members of having afinancial interest in the markets²an accusation that would later be proven true.Then, the U.S. Federal Reserve and its chairman, Paul Volcker, added to the Huntbrothers¶ troubles by strongly encouraging banks to stop making loans for speculative activity.

When Silver Sneezed, Gold Caught the Cold

On January 7, 1980, the other major U.S. exchange, COMEX, changed its rulesalso. Investors were limited to 10 million ounces in futures contracts, and anyamount above that had to be liquidated by Friday, February 18.6 On the very nexttrading day, Monday, January 21, as silver reached a record high of $50 an ounce,the Hunt silver hoard peaked at a mind-boggling $4.5 billion, (that¶s $43.5 billion inShadowstats CPI-adjusted 2011 dolars!)5On the same day that silver hit $50 and silver futures topped out at $52.50, gold¶sprice set a new record of $850 and gold futures peaked at $892. COMEX, terrifiedthat it would be forced into default, announced²with the backing of the CFTC²thattrading in silver would be limited to liquidation orders only, eliminating any buyers.With no new buyers, the price of silver could not go up. So this rule was basically thesame as saying, ³Until this rule is lifted, the price of silver will only go down.´ Of course, silver began to plummet, and on that same day so did gold.Was it just a coincidence that gold and silver peaked at the same time?Could it be that many large silver traders also held gold?Wouldn¶t the gold traders on the exchanges have known what happened to the silver traders and said to themselves, ³Oh my God«if they can do that to silver, then goldis probably next´?

(3) If at any time, on a verification made by a proper officer, it is found that any specified goodsowned, possessed or controlled by a person are lesser in quantity than the stock of such goods asshown, at the time of such verification, in the accounts referred to in sub-section (1), read with theaccounts referred to in sub-section (2), it shall be presumed, unless the contrary is proved, that suchgoods, to the extent that they are lesser than the stock shown in the said accounts, have beenillegally exported and that the person owning, possessing or controlling such goods has beenconcerned with the illegal export thereof.

SECTION 11M

.

Steps to be taken by persons selling or transferring any specified goods.

±Except where he receives payment by cheque drawn by the purchaser, every person who sells or otherwise transfers within any specified area, any specified goods, shall obtain, on his copy of thesale or transfer voucher, the signature and full postal address of the person to whom such sale or transfer is made and shall also take such other reasonable steps as may be specified by rules madein this behalf to satisfy himself as to the identity of the purchaser or the transferee, as the case maybe, and if after an inquiry made by a proper officer, it is found that the purchaser or the transferee, asthe case may be, is not either readily traceable or is a fictitious person, it shall be presumed, unlessthe contrary is proved, that such goods have been illegally exported and the person who had sold or otherwise transferred such goods had been concerned in such illegal export :Provided that nothing in this section shall apply to petty sales of any specified goods if the aggregatemarket price obtained by such petty sales, made in the course of a day, does not exceed twothousand and five hundred rupees.

Explanation.

- In this section ³petty sale´ means a sale at a price which does not exceed onethousand rupees.

Silver Linings: What the Hunt Brothers Can Teach Us Today

The Hunt brothers got into trouble because they exposed themselves to a huge amount of risk through their leveragedinvestments. Leverage makes a bigger impact when you¶re losing than it does when you¶re winning: It can be as bluntas a bowling ball on the way up, but as sharp as a surgical laser on the way down.The fundamental error the Hunts made was, there¶s simply no substitute for physical ownership of your own gold andsilver. Whether the Hunt brothers were victims of their own greed, the greed of board members on the exchanges, adesperate attempt by the Fed to save the dollar, or some combination of these things, it¶s clear that the fall of silver in1980 brought gold down with it and bought the dollar some extra time.We have no way of knowing how high gold and silver would have gone if the government and banking establishmenthadn¶t gone after the Hunt brothers. We¶ll never know if the dollar would have survived. We do know that gold peakedwhen silver peaked, and we know that gold fell when silver fell.In the near future, both of these metals may again start taking off into the stratosphere, and knowing the weakening of the Western economies and the rise of the Asian, it is inevitable that Nelsons law of gravitation may yet be disprove¶d.